When it comes to evaluating the financial health and performance of companies, one crucial aspect that investors pay close attention to is cash flow. Cash flow is the lifeblood of any business, providing the necessary funds for daily operations, investments, and growth. In this article, we will compare the cash flow of two tech giants, Apple and Hewlett Packard (HP), and analyze how it impacts their respective financial positions and future prospects.

Apple's Cash Flow Analysis

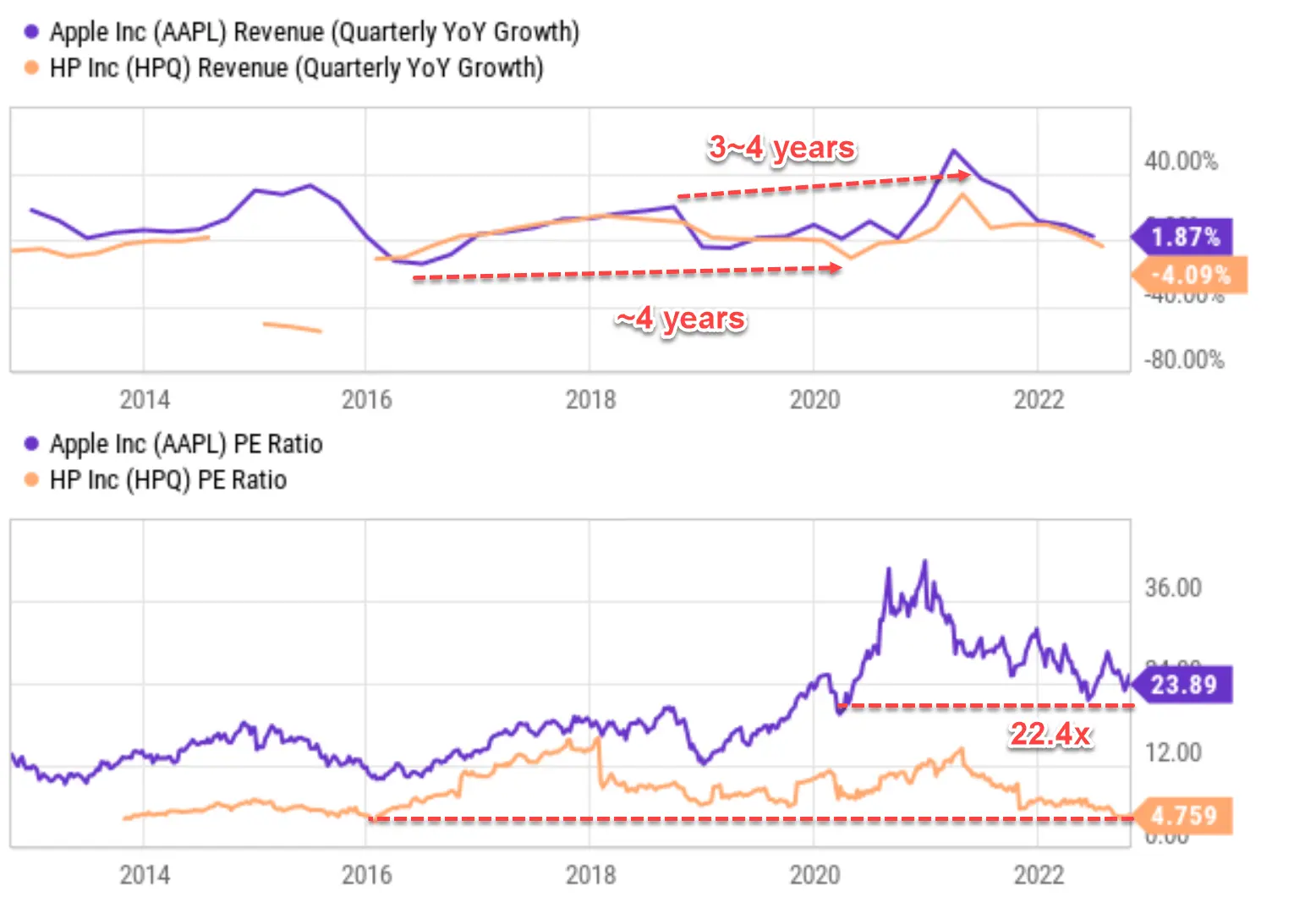

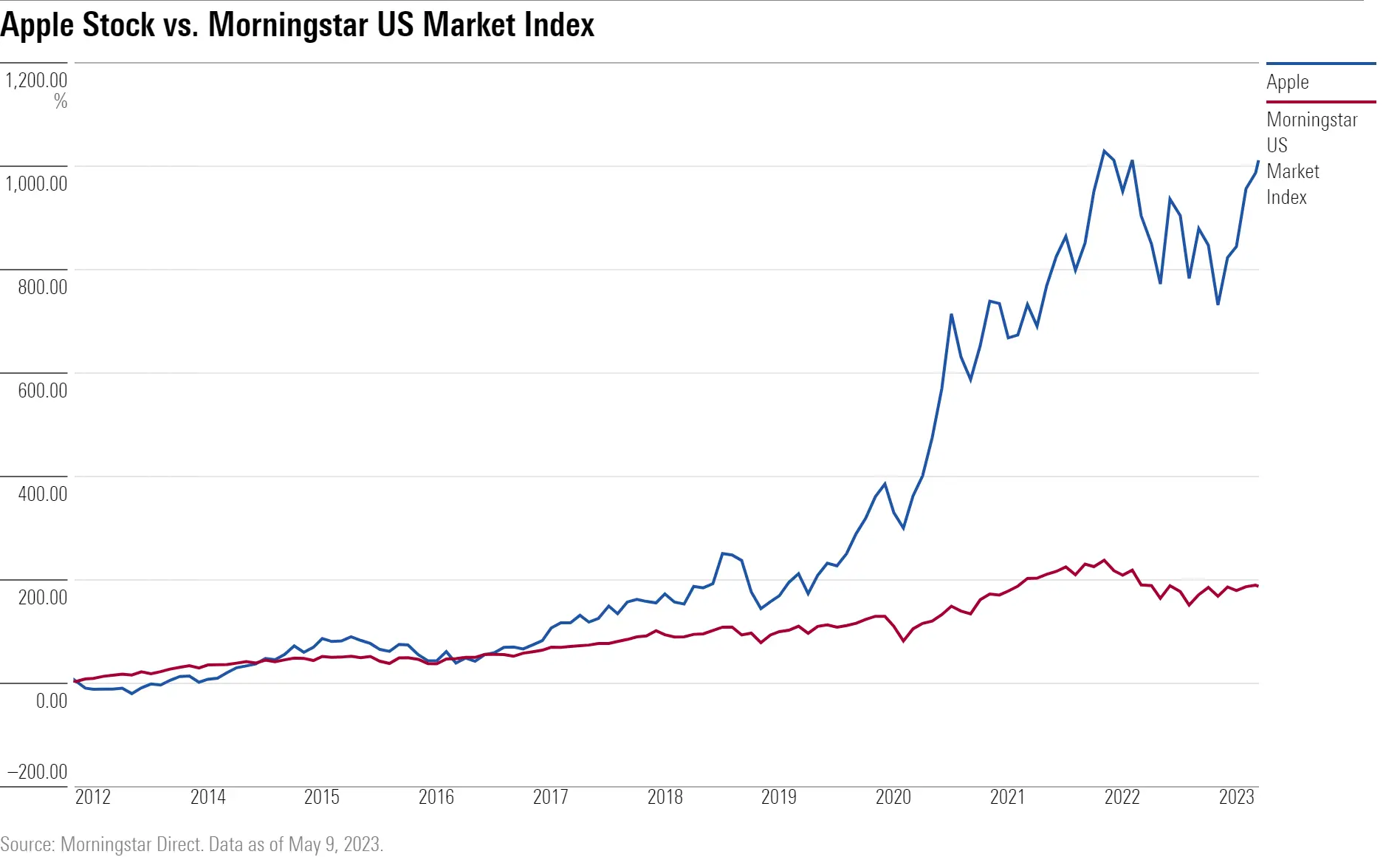

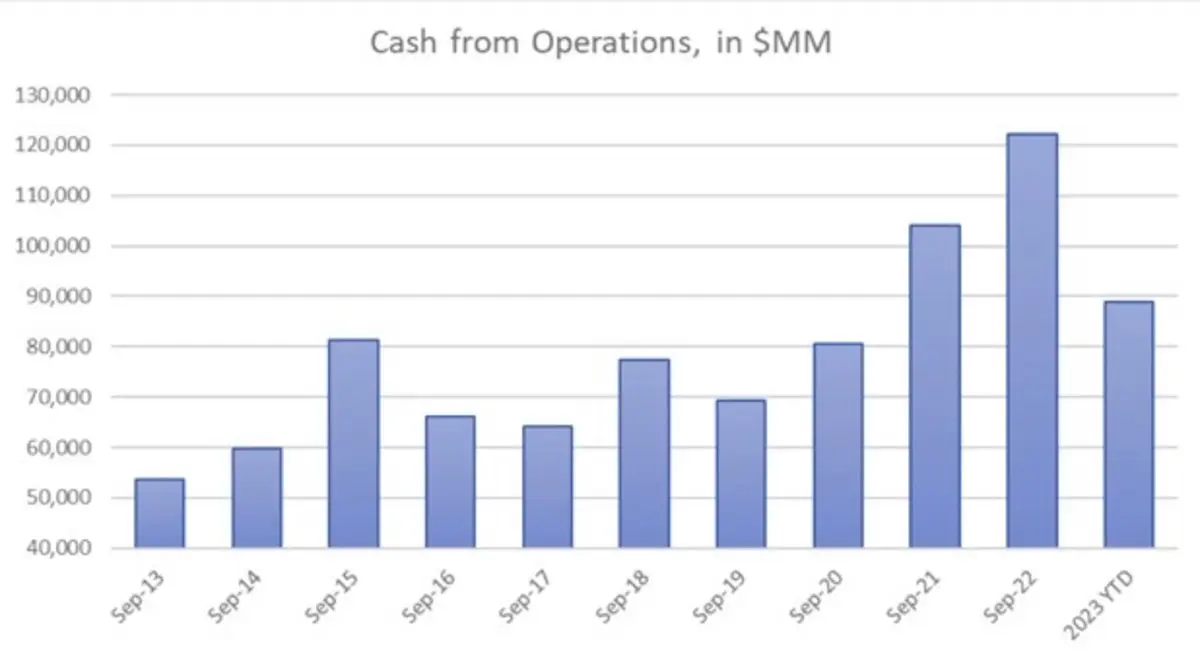

Apple, known for its innovative products and loyal customer base, has consistently demonstrated strong cash flow in recent years. In the fiscal year ending on September 30, 2023, Apple's free cash flow stood at approximately $100 billion, a slight decrease of 6% compared to the previous year's $114 billion.

This decline in cash flow can be attributed to various factors, including increased investments in research and development, acquisitions, and expansion into new markets. Despite the decrease, Apple's cash flow remains robust, indicating a healthy financial position and the ability to generate significant cash reserves.

Cash Flow Ratio of Apple

The cash flow ratio is a metric used to assess a company's ability to generate cash flow relative to its net income. It provides insight into how efficiently a company can convert its net income into cash flow. Unfortunately, the specific cash flow ratio for Apple is not provided in the available information.

Analyzing hewlett-packard (hpe) stock price: trends, factors, and analyst targets

Analyzing hewlett-packard (hpe) stock price: trends, factors, and analyst targetsCash Flow Margin of Apple

The cash flow margin is a measure of how much cash flow a company generates for every dollar of revenue. It indicates the company's ability to convert revenue into cash flow. Unfortunately, the specific cash flow margin for Apple is not provided in the available information.

However, it is important to note that Apple's consistent profitability, strong brand presence, and loyal customer base contribute to its ability to generate robust cash flow and maintain a healthy cash flow margin.

Cash Flow of Apple in 2023

In 2023, Apple's cash flow reached approximately $100 billion. This significant amount of cash flow provides the company with ample financial resources to invest in innovation, research and development, marketing, and other strategic initiatives. It also allows Apple to weather economic downturns and uncertainties more effectively than companies with weaker cash flow positions.

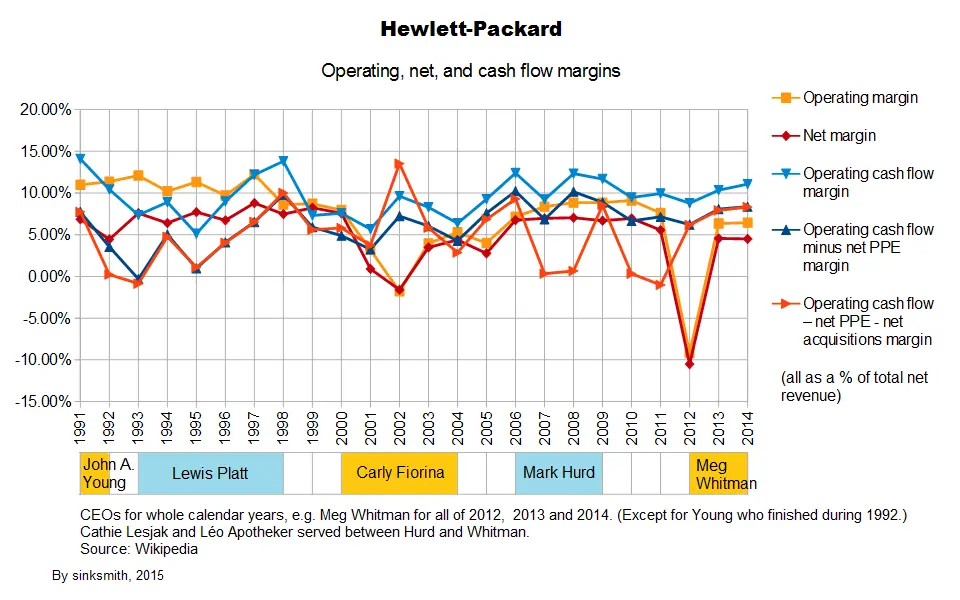

Hewlett Packard's Cash Flow Analysis

Hewlett Packard (HP), another prominent player in the technology industry, has also demonstrated a solid cash flow performance. However, it is important to note that HP's cash flow figures are not available in the provided information, making a direct comparison with Apple challenging.

Hpe careers: professional growth opportunities at hewlett packard enterprise

Hpe careers: professional growth opportunities at hewlett packard enterpriseNonetheless, HP's cash flow performance can be assessed by considering its overall financial position, profitability, and market presence. HP has a diversified product portfolio and strong customer relationships, contributing to its ability to generate consistent cash flow.

- Q: Does Apple have good cash flow?

- Q: What is the cash flow ratio of Apple?

- Q: What is the cash flow margin of Apple?

- Q: What is the cash flow of Apple in 2023?

A: Yes, Apple has consistently demonstrated strong cash flow performance, with approximately $100 billion in cash flow for 202

A: The specific cash flow ratio for Apple is not provided in the available information.

Hp - leading provider of technology products and services

Hp - leading provider of technology products and servicesA: The specific cash flow margin for Apple is not provided in the available information.

A: Apple's cash flow in 2023 reached approximately $100 billion.

Overall, both Apple and Hewlett Packard have demonstrated strong cash flow performance, indicating healthy financial positions and the ability to invest in future growth. While specific cash flow ratios and margins may not be available for both companies, their consistent profitability and market presence contribute to their ability to generate robust cash flow. Investors should consider these factors, along with other financial metrics and market trends, when evaluating the investment potential of these tech giants.