Are pensions good for life? This is a common question among individuals planning for retirement. Pensions, also known as defined benefit plans, offer a fixed monthly benefit for the rest of your life. Unlike 401(k) plans, which are defined contribution plans, pensions provide retirees with a level of certainty and security in their retirement income.

What do I do with my 401(k) after retirement?

After retirement, you have a few options for your 401(k) funds. You can leave the money in your former employer's plan, or you can roll over the funds into an Individual Retirement Account (IRA) or an annuity. Rolling over your 401(k) gives you more control over how your money is invested and allows for easier management and tracking of your retirement assets.

What are 401(k) rollover options?

Most people choose to roll over or transfer their 401(k) funds to an IRA or to the 401(k) plan of a new employer. Another option is a Roth IRA, where the money you put in is taxed, but withdrawals are tax-free. Cashing out your 401(k) is a less popular option due to significant penalties, including income taxes and an additional 10% penalty tax for individuals under age 59½. Consult with a tax advisor before making any withdrawals or rollovers.

Are there other retirement income options besides a 401(k)?

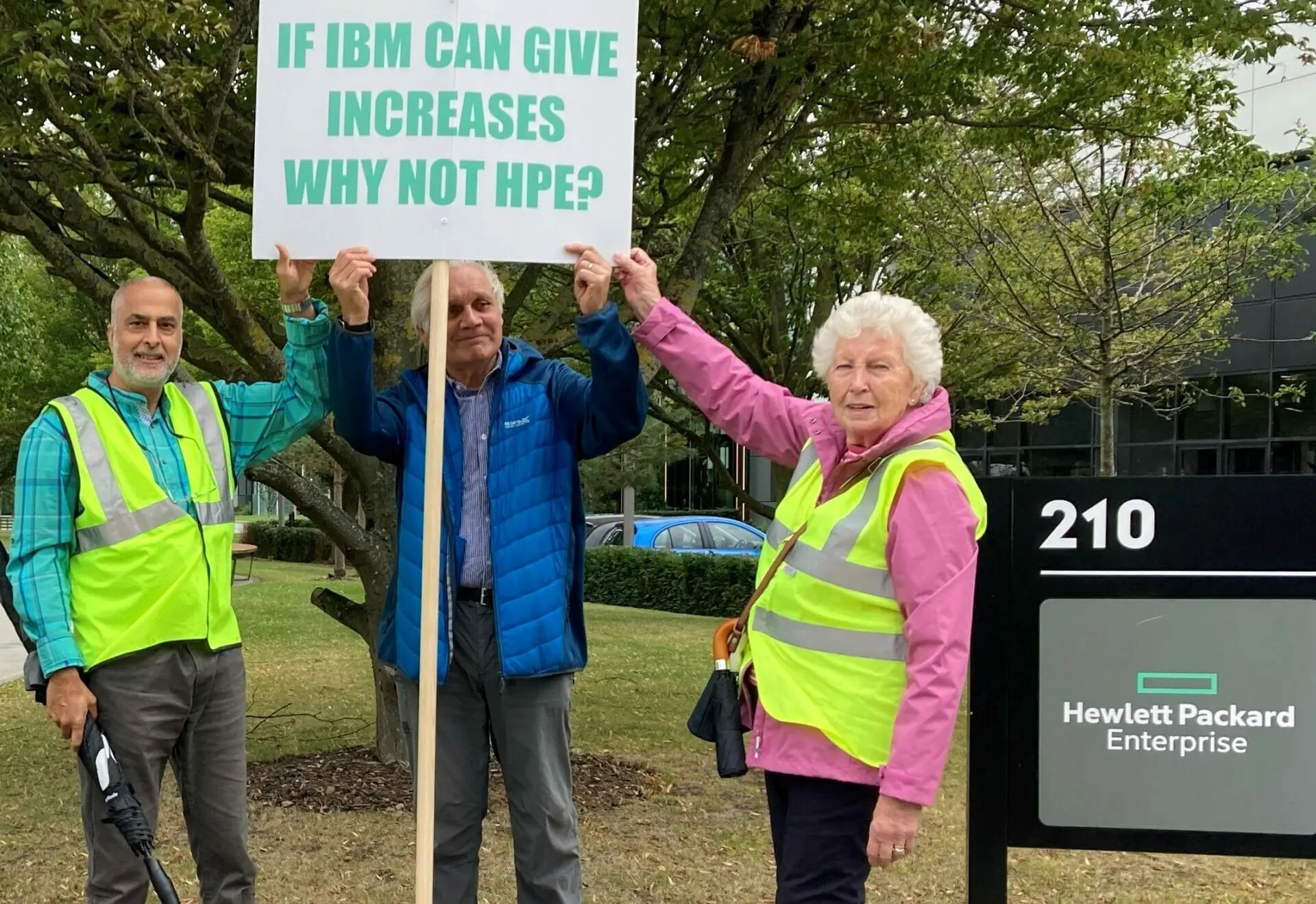

In addition to 401(k) plans, there are other retirement income options available. Traditional pensions, like those offered by Hewlett-Packard, provide a fixed monthly benefit for life. Another option is a Guaranteed Lifetime Income Annuity, which offers a steady stream of income guaranteed to last for the rest of your life, regardless of market fluctuations.

Hp sc300 plus scientific calculator - advanced features & user-friendly design

Hp sc300 plus scientific calculator - advanced features & user-friendly designWhat's the safest 401(k) option?

Many 401(k) plans offer a stable value option, which provides a guaranteed rate of return for the year. While this option preserves your money, it may not offer the same upside potential as riskier investment options.

Why do people with 401(k)s retire later?

Uncertainty is a key factor in why individuals with 401(k) plans tend to retire later. Unlike traditional pensions that promise a fixed monthly benefit, 401(k)s and other defined contribution plans do not provide such guarantees. With the responsibility of managing their own retirement savings, individuals often delay retirement to build a larger nest egg that can sustain them through their extended lifespan.

How much do you need for retirement?

The amount needed for retirement varies depending on the lifestyle one hopes to lead. Financial experts often suggest saving between $1 million and $2 million, but this figure is not one-size-fits-all. It's important to consider factors such as living expenses, healthcare costs, and desired retirement activities when determining the appropriate retirement savings goal.

Why companies no longer offer pensions

Companies have shifted away from offering pensions due to increased scrutiny and oversight on pension funds. Instead, many have opted for defined contribution plans, such as 401(k)s, where employees contribute funds to their own accounts. This shift allows companies to have a more hands-off approach to retirement benefits.

Max memory capacity of hewlett-packard model 1672

Max memory capacity of hewlett-packard model 1672Planning for retirement and understanding your pension options is crucial for financial security in your golden years. Whether you have a Hewlett-Packard pension or are considering a 401(k) rollover, it's important to weigh the pros and cons of each option and consult with a financial advisor to make informed decisions.