Hewlett-Packard, also known as HP, is a multinational technology company that specializes in developing and manufacturing computer hardware and software. Over the years, HP has become one of the leading companies in the technology industry, offering a wide range of products and services to consumers and businesses alike.

As with any large corporation, HP is subject to various taxes and regulations imposed by different jurisdictions. The term hewlett-packard tax refers to the taxes that HP is required to pay on its income and other financial activities.

Why does Hewlett-Packard pay taxes?

Like all businesses, HP is required by law to pay taxes on its profits. These taxes are used to fund public services and infrastructure, such as schools, roads, and healthcare. By paying taxes, HP contributes to the overall economic development of the countries and communities in which it operates.

HP's tax obligations are determined by the tax laws and regulations of the countries and states in which it operates. These laws specify the tax rates and the methods for calculating taxable income. HP's tax department works closely with tax professionals to ensure compliance with these laws and to optimize the company's tax position.

How does Hewlett-Packard calculate its taxes?

Hewlett-Packard calculates its taxes based on the taxable income it generates in each jurisdiction. Taxable income is determined by subtracting allowable deductions and expenses from the company's total income. HP's tax department works closely with its finance and accounting teams to accurately calculate and report its taxable income.

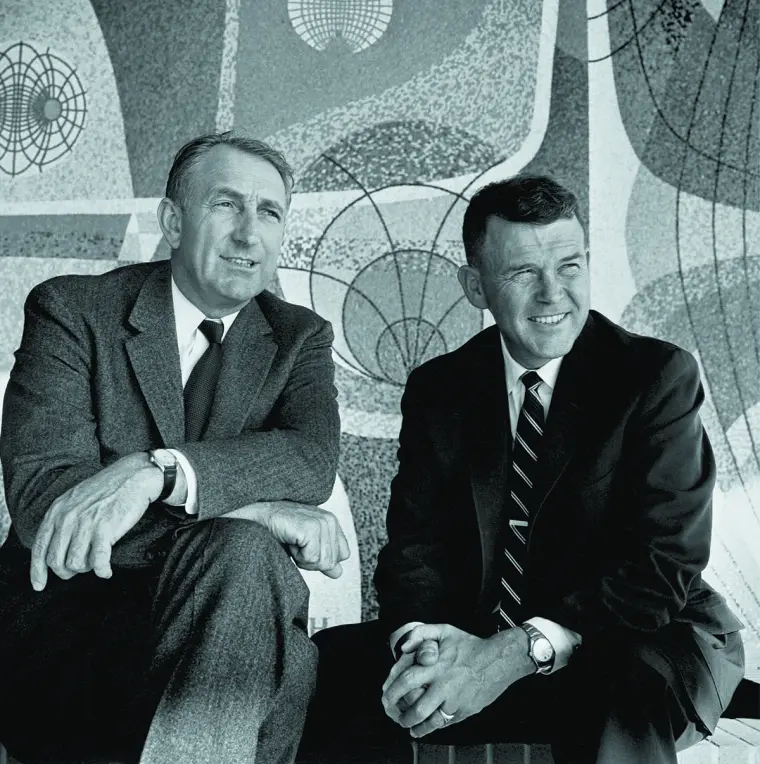

Hewlett & packard: pioneers in tech industry

Hewlett & packard: pioneers in tech industry

HP also takes advantage of various tax incentives and credits offered by different jurisdictions. These incentives are designed to encourage businesses to invest and create jobs in certain areas. By leveraging these incentives, HP can reduce its overall tax liability.

How does Hewlett-Packard ensure tax compliance?

Hewlett-Packard has a dedicated tax department that is responsible for ensuring compliance with tax laws and regulations. The tax department works closely with external tax advisors and auditors to stay up-to-date with the latest tax developments and to implement robust tax compliance processes.

HP also maintains a strong internal control environment to monitor and manage its tax risks. The company's finance and accounting teams work closely with the tax department to ensure accurate and timely reporting of tax information.

Frequently Asked Questions

- What happens if Hewlett-Packard fails to comply with tax laws?

Failure to comply with tax laws can result in penalties, fines, and legal consequences for HP. It is essential for the company to maintain a strong tax compliance program to avoid such risks. - Does Hewlett-Packard engage in tax avoidance?

Hewlett-Packard, like many other multinational corporations, aims to optimize its tax position within the boundaries of the law. This may involve taking advantage of tax incentives and credits offered by different jurisdictions. However, HP is committed to conducting its tax affairs in a transparent and responsible manner. - Does Hewlett-Packard contribute to the communities in which it operates?

Yes, Hewlett-Packard is actively involved in corporate social responsibility initiatives and community development projects. The company contributes to the communities in which it operates through various philanthropic programs, employee volunteering, and environmental sustainability efforts.

In conclusion

Hewlett-Packard, like any other multinational corporation, has significant tax obligations that it must fulfill. Through compliance with tax laws and regulations, HP contributes to the overall economic development of the countries and communities in which it operates. The company's tax department works diligently to ensure accurate tax calculations and reporting, while also taking advantage of available tax incentives. By maintaining a strong internal control environment and collaborating with external tax advisors, HP strives to meet its tax compliance obligations and optimize its tax position.

Analyzing hewlett-packard (hpe) stock price: trends, factors, and analyst targets

Analyzing hewlett-packard (hpe) stock price: trends, factors, and analyst targets